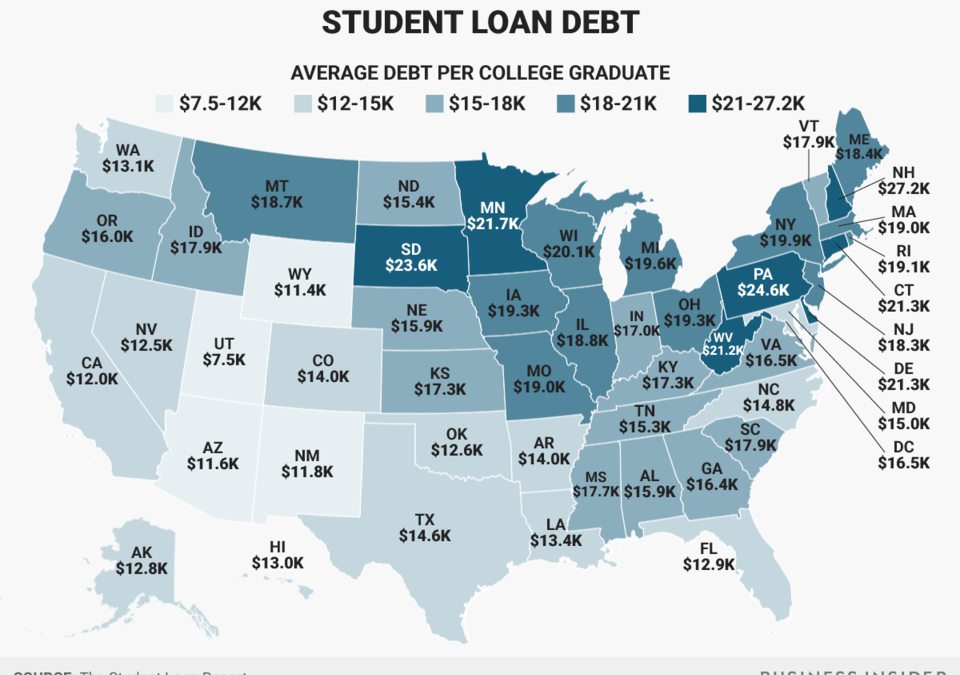

Graduation is right around the corner! Now is the time to celebrate all of your hard work and accomplishments. But what happens after you walk across the stage? Business Insider reports that the average debt per college graduate in the US is about $17,126. Do you have a plan to repay your student loans? Check out our top five tips for repaying your student loans after graduation.

- Know how much you owe. You’d be surprised at how many students don’t know how much they owe in student loans. You might forget about a loan you took out freshman year, however, your lender certainly didn’t forget.

- Choose the best payment plan for you. There are several types of repayment plans and just because you start with one, doesn’t mean you have to keep that same plan forever. Find out which plan might be best for you with the repayment estimator.

- Know your grace period. A grace period is how long you can wait after leaving school before you have to make your first payment.

- Avoid delinquency and default. Ignoring your student loans can lead to consequences that can last a lifetime. Not paying on your loans can lead to delinquency and default.

- Keep in contact with your lender. Ignoring your lender will do you no good. If you miss a payment or find yourself unable to afford repayment at any time let them know. They can offer you more effective options for your financial situation or allow you to defer your payments for a certain amount of time.

*Bonus: Make sure your contact information is up-to-date. If you move or change phone numbers be sure to update that information with your lender so you won’t miss out on important information they have to share with you.